Kentucky offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Office of Energy Policy

The Kentucky Solar Energy Society

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Kentucky Government

700 Capital Avenue

Frankfort, KY 40601

(502) 564-3449

Monday–Friday, 8:00 a.m. to 4:00 p.m.

LG&E and KU

4820 W Broadway, Louisville, KY

(502) 589-1444

(800) 331-7370

(800) 981-0600

Monday – Friday, 7 a.m. – 7 p.m.

Kentucky Office of Energy Policy

300 Sower Blvd

Frankfort, KY 40601

(502) 564-7192

[email protected]

Monday – Friday

9:00am – 5:00pm, subject to change

Louisville Weather Bureau

6201 Theiler Lane

Louisville, KY 40229-1476

(502) 969-8842

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

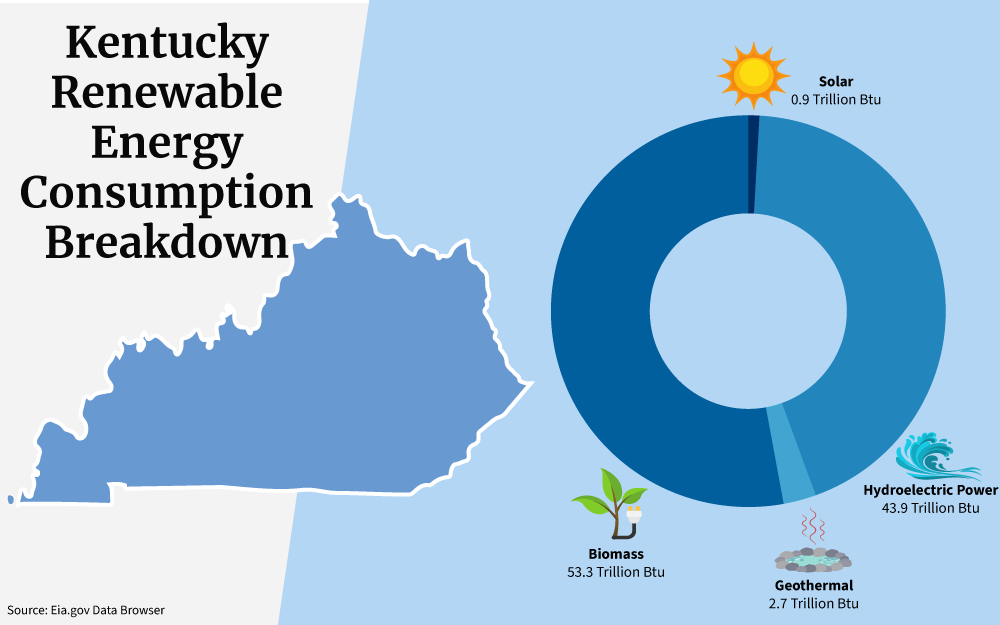

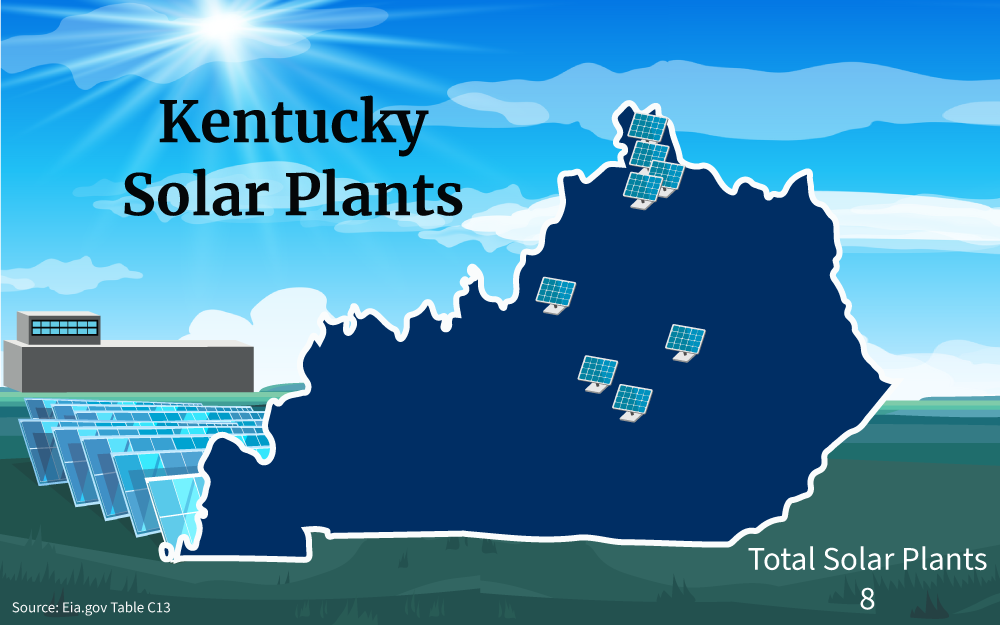

Kentucky is a state with excellent and as of now, mostly untapped solar potential. Although the Bluegrass State has made strides with solar energy in the last several years, it is still 71% coal-powered and gets less than 1% of its energy from solar power.

Kentucky Solar Credits and Ranking

With a number of Kentucky solar incentives available, including the Federal Tax Credit for Solar Photovoltaics available until 2032, energy-efficient mortgages and financing now available to residential customers, with open enrollment, the time to become energy independent from grid power has never been better.

In fact, solar panel prices have rapidly dropped as well, making household solar options more manageable for many residents.

This guide outlines the programs and registration steps for Kentucky residents.

The outlook for solar energy in the state of Kentucky is not at its brightest in 2023. With very few state laws and incentives to encourage solar development, the state appears to be slowing its solar progress for a time.

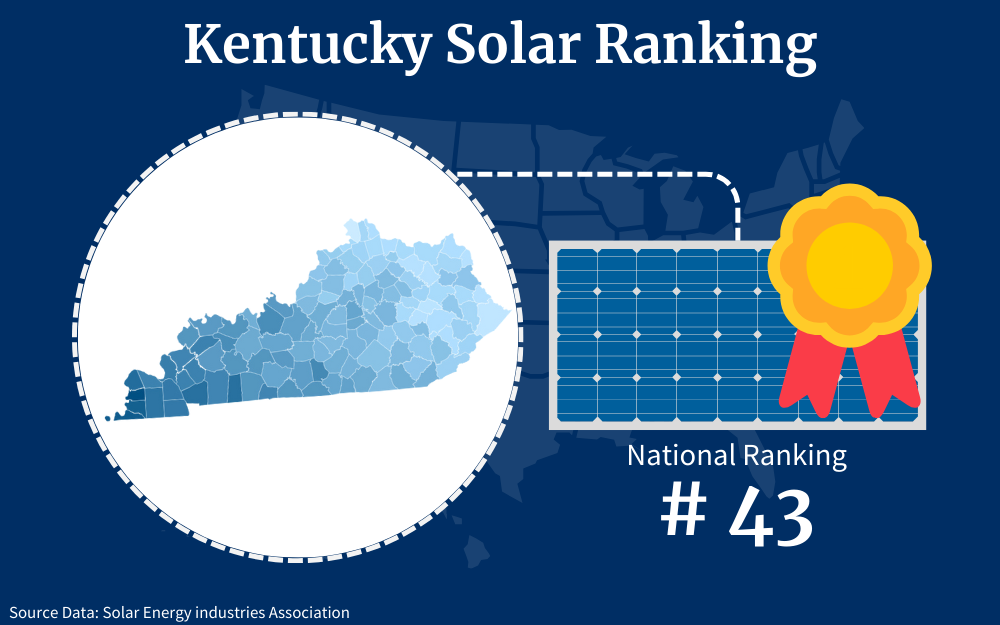

It’s currently ranked at number 43 in the nation for solar adoption.

However, there is still hope for Kentucky homeowners who want to install solar energy, as they can receive the 30% Federal tax credit through 2032.

Here are five interesting and sobering solar panel facts and solar energy facts in Kentucky:15

- Kentucky has only 165 MW of solar power installed throughout the state.

- There are 50 solar companies across the state, generating over 1,500 jobs.

- The price of solar installation has declined by more than 40% in the last decade.

- Kentucky is ranked 43rd out of all 50 states for solar progress.

- Per the Energy Information Administration (EIA), solar power accounts for only 0.2% of all electricity generated in the state (as of 2021).29

Solar Tax Credits for Kentucky Residents

Unfortunately for Kentucky residents, the state does not have a solar carve-out, nor does it offer residents a state-level tax credit for solar installation. Additionally, Kentucky offers neither sales tax nor property tax exemptions for residential solar, making the prospect of going solar daunting and even risky for many Kentuckians.

The good news is that Kentucky residents, like all other U.S. residents, are eligible for the former Federal Solar Investment Tax Credit (ITC), which is now called the Federal Tax Credit for Solar Photovoltaics. This is a 30% credit against taxpayer liability for the year in which the solar system was installed or first used and subsequent years until the credit is used in its entirety.

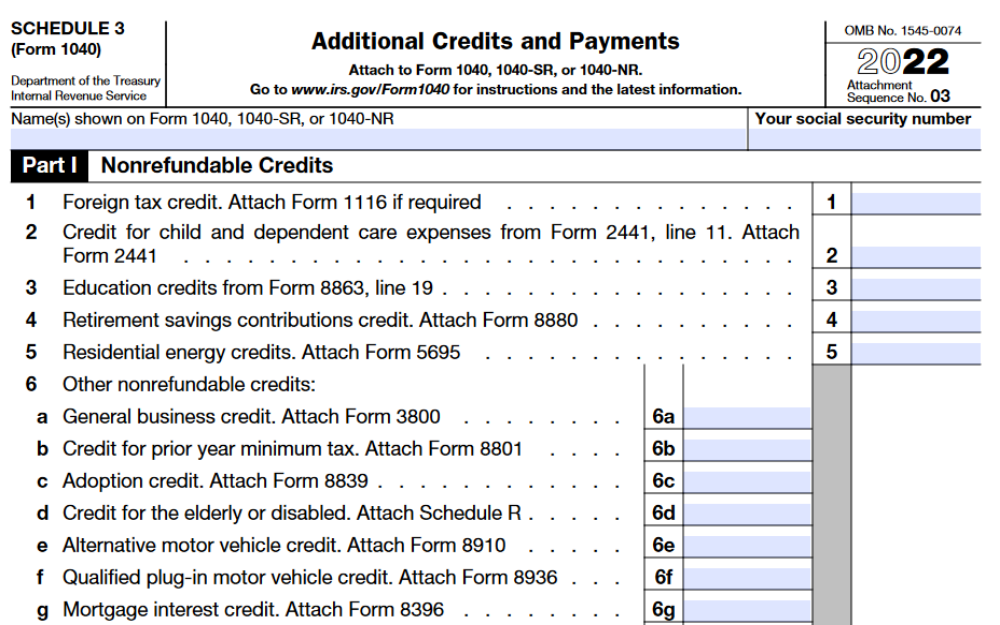

To apply for this Kentucky solar incentive, residents need only complete one extra form with their annual tax returns. The solar credit tax form that Kentucky homeowners with a newly installed or newly operational solar system will need to complete is the IRS Form 5695 Residential Energy Credits.

This form must be completed in full and submitted with annual tax return forms to qualify for the federal credit.

Are There Free Solar Panel Options in Kentucky?

The Kentucky Public Service Commission and the Kentucky Energy and Environment Cabinet oversee state programs and incentives across the Commonwealth.

Though the Bluegrass State does not have many statewide incentives for residential solar power, there are several programs that are working towards a more sustainable future, which will lower the cost of solar panels in Kentucky.

Continue reading to learn about how progress is being made.

State Programs or Incentives

Kentucky’s new energy strategy, called KYE3: Designs for a Resilient Economy outlines the state’s plans for moving forward from a place of energy awareness, focusing on energy education, energy assessment, and energy independence.35 Several initiatives are in the works for the state.

- National Energy Education Development (NEED) Project: The National Energy Education Development (NEED) Project is a program for training teachers to instruct children in energy education and train youth to become energy leaders.20

- Solar Siting Potential in Kentucky: Geographic Information System (GIS) Site Suitability Analysis is a program aimed at identifying ideal locations for utility-scale solar arrays.25

- Better Buildings Challenge and Better Climate Challenge: The Department of Energy’s Better Buildings Challenge and Better Climate Challenge partner with businesses, schools, cities, and so forth to encourage a firm commitment to lower greenhouse gas emissions and develop a cleaner energy portfolio. Within the state of Kentucky, the city of Louisville, Bullitt County Public Schools, Valvoline Inc., and Toyota Motor North America, Inc. have partnered through the programs.1

Federal Programs and Incentives

The Federal Solar Investment Tax Credit (ITC) is available to all U.S. taxpayers at an individual or business level, but the government is working towards a greener future through various other programs as well.

Greenhouse Gas Reduction Fund

The Greenhouse Gas Reduction Fund is an EPA-led program to invest $27 billion in combating climate change throughout America. The program is enacted through 3 grant competitions open to U.S. states, tribes, territories, municipalities, non-profits, etc.

- The National Clean Investment Fund is a $14 billion competition for providing financing for thousands of clean energy projects nationwide.19

- The Clean Communities Investment Accelerator is a $6 billion grant aimed at deploying clean energy technologies in underserved or disadvantaged communities.3

- Solar for All is a $7 billion competition aimed at increasing access to solar energy for low-income families.24

IRA Home Energy Rebates

The Inflation Reduction Act of 2022 allows $391 billion in funding for clean energy, $8.8 billion of which is dedicated to home energy efficiency rebates. States and territories across the U.S. are eligible to apply for this funding.10

Office of State and Community Energy Programs (SCEP)

The Department of Energy’s Office of State and Community Energy Programs helps state and local groups implement clean energy technology through the State Energy Program, in conjunction with newer programs such as Energy Future Grants.21

Energy-Efficient New Homes Tax Credit

The Credit for Builders of Energy-Efficient Homes awards up to $5,000 for newly built energy-efficient homes certified by the Zero Energy Ready Home Program.13

Energy-Efficient Mortgages

Energy Efficient Mortgages are available to individuals with energy-efficient homes as well as individuals planning to transition their homes to energy efficiency.7

How Can Home Solar Reduce Your Electricity Bills?

Investing in solar power energy for your home is certainly expensive up front, particularly when paying in cash, but a solar installation can amount to huge savings over time.

For homeowners looking to maximize their savings while reducing their carbon footprint through solar-generated electricity, here is what you need to know.

Net Metering in Kentucky

Several states across the U.S. still offer net metering to solar-generating customers. When residential or commercial customers install solar energy systems and tie their systems back into the electric grid, the solar power generated by these systems is fed to their utility company.

Net metering is a policy by which customers are compensated for extra solar units (KWhs) generated through credits against their bills.

Prior to 2020, the net metering policy in Kentucky was very favorable for solar customers, compensating solar generation capacity at a 1:1 ratio. But Kentucky’s net metering policy has recently taken heavy hits from utility companies attempting to maintain profit margins amidst rising coal costs.

According to the Kentucky Revised Statutes Chapter 278, as of January 2020 and current as of September 2023, utility companies are no longer required to compensate customers at a 1:1 ratio. Instead, the rate of compensation is set by the Kentucky Public Service Commission in conjunction with the electric utility company.

Although the exact rate has not been explicitly outlined, sources estimate returns to be only 55% of the retail price.9

This change makes it more difficult for Kentucky residents to recuperate the cost of their investment. However, for persons going solar for the sake of reducing their carbon footprints, net metering can still be a big perk.

Solar Renewable Energy Credits (SRECs)

Solar Renewable Energy Credits (SRECs) are financial/legal tools that incentivize solar energy production by allowing customers who generate solar power to accrue and sell SRECs to utility companies in their state.

A single SREC is the equivalent of 1 MWh (1,000 KWh) of electricity generated, and the certificates can be sold in states that have an SREC market.28

Unfortunately, there is no SREC market in the state of Kentucky. Kentucky residents may be able to sell SRECs in the Ohio and Pennsylvania (PA – Tier I) markets, but these markets are already over-saturated and unlikely to generate much income.27

Power Purchase Agreements (PPAs)

Power Purchase Agreements (PPAs) are contracts between sellers and buyers of electricity for a predetermined period of time. With a PPA, a customer can obtain solar power at no cost from a third-party solar developer who pays to install and maintain a solar energy system on the customer’s property.

The developer will retain ownership of the solar energy system, and for the term of the contract, the customer will purchase the solar energy generated by the panels on their property from the developer, or seller.

PPAs are not available to residential customers in Kentucky.4

How To Get Free Solar Panels From the Government

In an ideal world, solar panels would be free, but unfortunately, this is not the reality right now. The US Department of Energy Solar Blog reports that the federal government does not have a program for free solar installation, and customers should be leery of websites claiming otherwise.23 What the federal government does offer is a significant tax credit for U.S. taxpayers who install solar energy systems for their homes. Commercial and industrial tax credits are also available.

The Federal Solar Investment Tax Credit (ITC) is a credit against taxpayer liability for 30% of a homeowner’s total solar installation costs. Taxpayers benefit from this credit as a deduction rather than a refund, and unused portions can be rolled over to the next year.

Thanks to the Inflation Reduction Act of 2022, the 30% ITC has been extended out to 2032, at which point returns diminish annually.

Am I Eligible for the Federal ITC?

The next question to address is eligibility for the Federal ITC. To be eligible for the ITC, a homeowner must:

- Be a U.S. taxpayer

- Own (no lease or PPA) a solar system or own an interest in a community solar project

- Have installed or first used the system during the tax year of filing

- Have installed the system on a primary or secondary residence in the United States

Are you wondering, “When Do Federal Credits Expire?” Well, there are two ways to look at this question, but both ways may lead to the same eventual answer.

Firstly, the Federal ITC itself is set to begin its phase-out in 2033 and expire at the beginning of 2035. Secondly, if you have unused ITC credits from a solar installation, those credits will continue to roll over until the ITC is no longer in effect.18

How To Apply for the Federal ITC

Applying for the Federal ITC is actually extremely simple, another great advantage of this program. To get started, you need to make sure you have the right tax forms.

Concerning solar tax credit forms, Kentucky residents will have to complete the same form as any other U.S. taxpayer. Follow these steps to apply for the Federal ITC:

- During tax season, download IRS Form 5695 – Residential Energy Credits.

- Use the Instructions for Form 5695 to fill out Form 5695 completely and accurately.

a. Enter the cost of your solar installation on Line 1 of Part 1.

b. Complete the outlined calculations to fill in Lines 6a and 6b.

c. Transfer amount from Line 6b to Line 13.

d. Complete the worksheet on Page 4 of the Instructions for Form 5695 to fill in Line 14.

e. Follow instructions to fill in Lines 15 and 16. - Copy the amount on Line 15 to Schedule 3 Form 1040 Line 5.

- Complete Part II, specifically Lines 17a-c, 18, and 26-30, according to the instructions.

- Submit all tax forms by April 18th for the tax year of the system installation.8

Home Solar Installation Expenses and Materials

Residential solar systems can be quite expensive to install. Aside from the price of the panels themselves, there are also various materials and soft costs associated with installation that must be accounted for.

The Cost of Solar Panels in Kentucky

NREL lists the module price as $0.47/watt for a 6.2 kW system, but there is significant wiggle room here.30 The two types of solar photovoltaic panels most common in residential installations are monocrystalline and polycrystalline solar cells.

The more efficient monocrystalline panels usually cost between $1.00 and $1.50 per watt while polycrystalline solar cells cost between $0.70 and $1.00 per watt.

The Cost of Solar System Components

A successful solar power home requires more than solar panels to operate. The system also requires mounting hardware, electrical wiring, and an inverter to convert the direct current charge to an alternating current charge.

Some homeowners may opt to add on extra battery storage or solar panel covers to diversify and maximize their investment. Here are some average costs, cost ranges, and cost estimates for solar system components.30

- Racking (Mounting) Hardware: $0.10/watt

- Electrical Wiring: $0.19 to $0.27/watt

- Inverter: String → $0.12/watt, String w/ Power Optimizer → $0.18/watt, Microinverter → $0.39/watt

Soft Costs of Solar Installation

The soft costs are the lesser-seen aspects of solar installation. They have nothing to do with the physical components of the system and everything to do with supporting the industry by covering solar company expenses.

The soft costs of solar typically include inspection and permitting, sales tax, installation labor, supply chain, marketing, and overhead and profit. The DOE suggests that soft costs may account for up to 65% of the total solar investment.26

NREL’s estimates are below:

- Inspection, Permitting, Interconnection: $0.06/watt (~8% of total costs)

- Sales Tax: 6.9% (~2% of total costs)

- Installation Labor: ~$15.00 – $40.00 hourly (~7% of total costs)

- Supply Chain: Varies by company (~9% of total costs)

- Marketing & Sales (installer and integrator combined): $0.74/watt (~18% of total costs)

- Overhead (installer and integrator): $0.66/watt (including profit, ~21% of total costs)

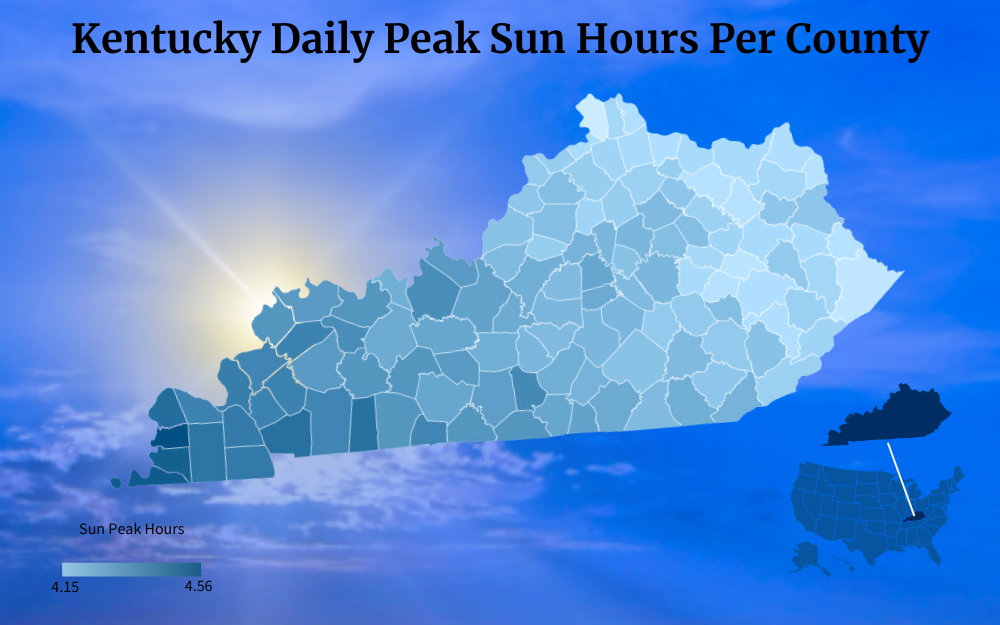

How To Use a Residential Solar Panel Calculator: Daily Peak Sunlight in KY

A solar panels output calculator can give you an idea of how much electricity a solar system will generate so that you can then determine the appropriate sized solar array for your home.

Understanding how many hours of sunlight your solar panels can gather is an important part of the equation.

The NREL’s PV Watts Calculator is an excellent solar estimator that generates accurate numbers. To use this calculator:

- Enter the address where the solar system would be located

- Modify the “System Info” to fit your property

- View “Results” to see annual kWh production as well as a monthly breakdown

It is possible to calculate required solar power manually in lieu of a solar power home calculator, but the results won’t be as detailed or specific as what the NREL calculator provides.

Manual Calculation of Solar System Size

To calculate the solar system size manually, you’ll need to go through a few steps.

- Calculate Your Energy Usage: Use your energy bills to see how much electricity your household uses on a monthly basis. Divide that number by 30 to obtain your approximate daily usage in kWh.

The average Kentucky household uses 35 kWh daily.32 - Research Peak Sun Hours (Use NREL Solar Resource Maps): Most of Kentucky averages around 4.25 peak hours each day.

- Calculate kW Output:11 Divide daily energy usage by peak sun hours.

[Ex. 35/4.25 = 8.24 kW daily solar output] - Calculate for Loss and Inefficiencies:12 Use a margin of 20 to 30% to account for inefficiencies. Add the percentage to 100 and convert to a decimal. Multiply your output by the efficiency factor.

[Ex. 20% → 8.24 x 1.2 = 9.89 → 10 kWh system or 30% → 8.24 x 1.3 = 10.71 → 11 kWh system]

How To Find KY Solar Panels

Suppose you have decided you are ready to take the plunge and invest in a solar energy system, and now you are wondering where to begin.

There are some best practices for getting your solar project started.

Things To Consider Before Installing Your Solar System

Prior to installing your solar system, consider these 10 important steps:

- The energy efficiency of your home. Evaluate the energy efficiency of your home to ensure your investment won’t be wasted.

Improve insulation and upgrade to energy-efficient windows and appliances. - The size and condition of your roof. Some rooftops are too small for a sufficiently sized solar installation, and a roof in poor condition could lead to a more significant monetary investment.

- The direction your roof is facing. South-facing solar panels are ideal for maximizing solar energy, so if you do not have a south-facing rooftop, you may need to consider other mounting options to maximize your solar efficiency.

- The amount of sunlight vs. shade your roof receives. Solar panels are installed on the part of the roof that receives the most direct sunlight, so consider removing trees to eliminate significant shading issues.

Also, consider solar easement contracts with neighbors (see Kentucky Statutes 381.200). - If you qualify for any local incentives. Kentucky residents living in certain cities may qualify for local solar incentives (see Solarize Lexington and Solar Over Louisville).

State utilities may also offer rebates. - How much money you can save on monthly energy? Review energy bills to determine average usage.

Also take note of the money that goes towards other energy sources, such as natural gas, as solar energy systems will not lower those prices. - Scheduling a consultation with a solar expert. Many solar companies offer free consultations.

These can be highly informative for homeowners seeking more information about how to get the most out of a solar energy system. - Calculating what size solar energy system you will require. Calculate the necessary solar system size using the formula in the previous section or use NREL’s PV Watts Calculator.

- The type of solar panels that will best suit your needs. As discussed above, monocrystalline panels are both more expensive and more effective than polycrystalline.

Monocrystalline panels average 350 watts compared to 250 watts for polycrystalline.31 - If additional equipment or components are desired (battery storage, solar covers, power optimizers, etc.) Extra options such as solar batteries and microinverters can really up the price of a solar system, so bear this in mind when figuring out your cost/efficiency balance.2

If you have gone through these 10 steps and decided to proceed with your solar investment, you want to begin researching solar manufacturers and installers.

Solar Manufacturers and Installers in Kentucky

When choosing solar manufacturers and installers, ensure that their warranty is up to the 25-year standard and their prices are commensurate with other companies. Use the North American Board of Certified Energy Practitioners (NABCEP) directory to find qualified professionals in your area.

The Kentucky Solar Energy Society also has a directory of certified consultants and contractors in the Bluegrass State.16

How KY Solar Panels Work and Their Impact on the Environment

Understanding the solar panels’ environmental impact requires understanding a little about how solar panels work. So, what is the solar process that results in the production of energy?

Inside the sun, the collision and subsequent fusion of hydrogen atoms in a proton-proton (PP) chain reaction results in nuclear fusion, a process that creates tremendous amounts of energy.17

The sunlight reaches the earth in the form of photons that can be captured by solar panels. The prevailing solar technology for residential installations is solar photovoltaic cells (discussed above).

Solar PV cells work by absorbing photons and releasing negatively charged free electrons which then migrate to the panels’ surface, creating an electrical imbalance/charge that is harnessed for electrical energy.22

The environmental impact of solar energy is overwhelmingly positive, and the sustainability of solar energy continues to improve as solar technologies advance.

Is Solar Energy Bad?

Have you ever wondered why solar energy is bad or at least what bad things about solar energy have individuals and businesses second-guessing the choice to go solar?

Well, there are a few problems with solar energy that researchers, policymakers, and tech developers are still trying to work through. The biggest solar energy problems facing the solar industry today are how to reduce the carbon emissions from manufacturing and how to handle end-of-life solar panels.

- The process of making solar panels relies on raw material mining, burning of fossil fuels, and water consumption. Using recycled materials and water, and running solar facilities on renewable energy can help offset this problem.

- After their long lives, solar panels have the potential to create a large waste issue. Recycling programs for retired PV systems can reduce the carbon footprint of manufacturing and disposal.

Note that the negative effects of solar panels are soon offset by the carbon emissions they eliminate during their long lifetimes. In fact, the average solar system produced today has a lifetime of more than 30 years, and the U.S. Energy Information Administration (EIA) reports that the carbon emissions from manufacturing are canceled out in under 4 years.

The Appalachian region of the United States has long relied heavily on coal and natural gas production and consumption to support the economy. The transition to renewable energy and solar in particular has been slower in these states, including Kentucky.

By understanding the Kentucky solar incentives available, residents can make informed decisions about how to lower their energy costs and provide themselves with reliable, green electricity from the sun.

Frequently Asked Questions About Kentucky Solar Incentives

Does Kentucky Offer a State Tax Credit for Solar Installation?

Kentucky does not offer a state-level tax credit to residents for solar investments, but it does enforce a favorable net metering policy and encourages local incentivization. Some local incentives are specific to particular counties or cities, while other incentives may be utility-based.34

How Much Does Solar Increase the Value of Kentucky Homes?

What Is the Average Cost of Solar Panel Installation in Kentucky?

Most sources agree that the average Kentucky residence requires a 10 kW solar energy system to meet all the home’s electricity needs. According to EnergySage.com, the cost of solar panels in Kentucky comes out to approximately $3.19 per watt, making a 10 kW system around $32,000 and a smaller 6 kW system around $19,000 before tax credits.14

References

1US Department of Energy. (2023). Better Buildings Challenge: Partner Lists: By State | Better Buildings. Better Buildings Initiative. Retrieved September 8, 2023, from <https://betterbuildingssolutioncenter.energy.gov/challenge/partner-list-state>

2Bloch, E. (2022, July). 10 Factors to Consider Before Installing Solar Panels. Modernize. Retrieved September 7, 2023, from <https://modernize.com/homeowner-resources/solar/10-factors-consider-going-solar>

3US Environmental Protection Agency. (2023, July 14). Clean Communities Investment Accelerator | US EPA. EPA. Retrieved September 8, 2023, from <https://www.epa.gov/greenhouse-gas-reduction-fund/clean-communities-investment-accelerator>

4Kentucky Energy and Environment Cabinet. (2018, June). Consumer energy Management & access guide. Kentucky Energy and Environment Cabinet. Retrieved September 7, 2023, from <https://eec.ky.gov/Energy/Documents/Consumer%20Energy%20Management%20and%20Access%20Guide.pdf>

5This Old House. (2023, May 17). Do Solar Panels Increase Home Value? (2023 Guide). This Old House. Retrieved September 6, 2023, from <https://www.thisoldhouse.com/solar-alternative-energy/reviews/do-solar-panels-increase-home-value>

6This Old House. (2023, May 17). Do Solar Panels Increase Home Value? (2023 Guide). This Old House. Retrieved September 8, 2023, from <https://www.thisoldhouse.com/solar-alternative-energy/reviews/do-solar-panels-increase-home-value>

7Energy Star. (2023). Energy Efficient Mortgages. Energy Star. Retrieved September 8, 2023, from <https://www.energystar.gov/newhomes/mortgage_lending_programs/energy_efficient_mortgages>

8Wakefield F. (2023, September 1). Federal Solar Tax Credit Guide for Homeowners (2023). MarketWatch. Retrieved September 7, 2023, from <https://www.marketwatch.com/guides/home-improvement/federal-solar-tax-credits/>

9SolarReviews. (2023). Guide to Kentucky incentives & tax credits in 2023. SolarReviews. Retrieved September 7, 2023, from <https://www.solarreviews.com/solar-incentives/kentucky>

10US Department of Energy. (2023). Home Energy Rebate Program. Department of Energy. Retrieved September 8, 2023, from <https://www.energy.gov/scep/home-energy-rebate-program>

11Unbound Solar. (2020, July 14). How to Size a Solar System: Step-by-Step. Unbound Solar. Retrieved September 7, 2023, from <https://unboundsolar.com/blog/how-to-size-solar-system>

12GoGreenSolar. (2023). How to Size a Solar System [Step-by-Step Guide]. GoGreenSolar.com. Retrieved September 7, 2023, from <https://www.gogreensolar.com/pages/sizing-solar-systems>

13Internal Revenue Service. (2023, January 31). Instructions for Form 8908 (01/2023) | Internal Revenue Service. IRS. Retrieved September 8, 2023, from <https://www.irs.gov/instructions/i8908>

14EnergySage. (2023, March 15). Kentucky Solar Panel Cost: Is Solar Worth It In 2023? EnergySage. Retrieved September 6, 2023, from <https://www.energysage.com/local-data/solar-panel-cost/ky/>

15Solar Energy Industries Association. (2023). Kentucky Solar | SEIA. Solar Energy Industries Association. Retrieved September 7, 2023, from <https://www.seia.org/state-solar-policy/kentucky-solar>

16Kentucky Solar Energy Society. (2020). Directory of Solar Installation Contractors & Consultants in Kentucky. Kentucky Solar Energy Society. Retrieved September 7, 2023, from <https://www.kyses.org/installers>

17Meng, W. H. (2023, June 6). Solar Energy. National Geographic Education. Retrieved September 7, 2023, from <https://education.nationalgeographic.org/resource/solar-energy/>

18Murphy, L., & Pelchen, L. (2023, August 7). Federal Solar Tax Credit Guide For 2023 – Forbes Home. Forbes. Retrieved September 7, 2023, from <https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state/>

19US Environmental Protection Agency. (2023, July 14). National Clean Investment Fund | US EPA. EPA. Retrieved September 8, 2023, from <https://www.epa.gov/greenhouse-gas-reduction-fund/national-clean-investment-fund>

20The NEED Project. (2023). The National Energy Education Development Project – NEED. National Energy Education Development Project. Retrieved September 8, 2023, from <https://www.need.org/about-need/>

21Department of Energy. (2023). Office of State and Community Energy Programs. Department of Energy. Retrieved September 8, 2023, from <https://www.energy.gov/scep/office-state-and-community-energy-programs>

22U.S. Energy Information Administration. (2023, May 26). Photovoltaics and electricity. EIA. Retrieved September 7, 2023, from <https://www.eia.gov/energyexplained/solar/photovoltaics-and-electricity.php>

23Robles, J. (2023, April 26). Free Solar Panels? Don’t Get Burned. Department of Energy. Retrieved September 7, 2023, from <https://www.energy.gov/articles/free-solar-panels-dont-get-burned>

24US Environmental Protection Agency. (2023). Solar for All. EPA. Retrieved September 8, 2023, from <https://www.epa.gov/greenhouse-gas-reduction-fund/solar-all>

25Kentucky Energy and Environment Cabinet. (2021). Solar Siting Potential in Kentucky. Kentucky Energy and Environment Cabinet. Retrieved September 8, 2023, from <https://solar-siting-potential-in-kentucky-kygis.hub.arcgis.com/>

26Solar Energy Technologies Office. (2023). Solar Soft Costs Basics. Department of Energy. Retrieved September 7, 2023, from <https://www.energy.gov/eere/solar/solar-soft-costs-basics>

27SRECTrade, Inc. (2023). SREC Markets | Kentucky | KY. (n.d.). SRECTrade. Retrieved September 7, 2023, from <https://www.srectrade.com/markets/rps/srec/kentucky>

28Thoubboron, K. (2022, August 2). SRECs: Solar Renewable Energy Credits Explained | EnergySage. EnergySage Blog. Retrieved September 7, 2023, from <https://news.energysage.com/srecs-complete-overview/>

29U.S. Energy Information Administration. (2022. August, 18). Profile Analysis. U.S. Energy Information Administration. Retrieved September 7, 2023, from <https://www.eia.gov/state/analysis.php?sid=KY>

30Fu, R., Feldman, D. and Margolis, R. (2018, October). U.S. Solar Photovoltaic System Cost Benchmark: Q1 2018. NREL. Retrieved September 7, 2023, from <https://www.nrel.gov/docs/fy19osti/72133.pdf>

31Weinberger, D. (2023, January 5). Types Of Solar Panels: What You Should Know – Forbes Home. Forbes. Retrieved September 7, 2023, from <https://www.forbes.com/home-improvement/solar/types-of-solar-panels/>

32Wilson, L. (2022, October 24). Average Household Electricity Consumption – 2023. Shrink That Footprint. Retrieved September 7, 2023, from <https://shrinkthatfootprint.com/average-household-electricity-consumption/>

33Simms, D. (2023, September 1). Is Solar Worth It in Kentucky? (2023 Homeowner’s Guide). EcoWatch. Retrieved September 6, 2023, from <https://www.ecowatch.com/solar/worth-it/ky>

34Simms, D. (2023, September 1). Kentucky Solar Incentives (Rebates, Tax Credits & More in 2023). EcoWatch. Retrieved September 6, 2023, from <https://www.ecowatch.com/solar/incentives/ky>

35Commonwealth of Kentucky. (2022). Kentucky Energy Strategy KYE3. Kentucky Energy and Environment Cabinet. Retrieved September 8, 2023, from <https://eec.ky.gov/Energy/Pages/KYE3.aspx>

36Screenshot from Internal Revenue Service. IRS. Retrieved from <https://www.irs.gov/pub/irs-pdf/f1040s3.pdf>